Beyond its terrible death toll and massive public health implications, the COVID-19 pandemic and the lockdown measures put in place to try to contain or mitigate it are bound to have severe and long-lasting economic effects. The European Union (EU) and its economic and financial governance now face very significant challenges, possibly exceeding those of the 2008 crisis. The way in which these challenges are addressed will not only determine the path and speed of European (economic) recovery, but perhaps also pave the way for further changes beyond the pandemic. Here I reflect on some implications of the COVID-19 response for EU-wide public debt instruments.

EU’s COVID-19 Package

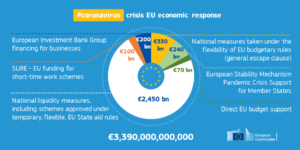

The EU’s initial reaction to the COVID-19 related economic crisis has been to formally approve on 23 April 2020 a ‘comprehensive economic policy response to the COVID-19 pandemic’, amounting to a package worth 540 billion Euro due to be operational from 1 June 2020 (the ‘COVID-19 Package’). Together with the measures adopted at national level and quickly approved under a temporary EU State aid rules framework, the COVID-19 Package amounts to an economic support package worth almost 3.4 trillion Euro. Its effectiveness and sufficiency will only be observable in the coming months or years and further aggressive economic policy making should not be discarded at this stage.

Source: European Commission, 20 Apr 2020.

SURE as a mechanism to access international capital markets

The COVID-19 package includes some innovative mechanisms. Notably, the European Commission’s initiative called ‘Support mitigating Unemployment Risks in Emergency’ (SURE), which establishes ‘ for the duration of the emergency, a temporary loan-based instrument for financial assistance under Article 122 of the Treaty on the Functioning of the European Union’. The mechanism aims to make up to 100 billion Euro available in favourable loans to the Member States heaviest hit by the pandemic, with the main aim of helping them protect people in work and jobs affected by the pandemic. In rough terms, the mechanism will require Member States to collectively underwrite 25 billion Euro in guarantees, so that the European Commission can issue debt of up to 100 billion Euro on capital markets—although the mechanism is intended to rely inasmuch as possible on the EU budget rather than debt instruments.

This is not an entirely new approach, as the European Commission is empowered to borrow from the international capital markets, on behalf of the European Union. The EU currently has three loan programmes to provide financial assistance to countries experiencing financial difficulties, all of which are funded through bonds issued on the capital markets. However, none of them is based on Art 122(2) TFEU, which is tailored to situations ‘Where a Member State is in difficulties or is seriously threatened with severe difficulties caused by natural disasters or exceptional occurrences beyond its control, [so that] the Council, on a proposal from the Commission, may grant, under certain conditions, Union financial assistance to the Member State concerned.’

A hub and spoke, not a centralised public debt mechanism

SURE is a ‘hub and spoke’ international public debt mechanism, in the sense that the European Commission is meant to create a centralised pool of available funds to be unevenly distributed to the Member States with greater need. The solidarity aspect lies in the fact that all the Member States—whether future beneficiaries of SURE or not—are accepting credit risk by underwriting the issue of EU bonds, as well as accepting the likely potential absorption (through the EU budget) of differentials in borrowing costs between the cost of the EU’s international indebtedness and the favourable terms of the loans given to the Member States. The financial attractiveness of the SURE programme for beneficiary Member States entirely lies on the assumption that the EU will be able to borrow (and lend) more cheaply than those Member States could indebt themselves. Therefore, for SURE to be effective, there should indeed be a financial advantage for beneficiary Member States, even if it comes at the cost of spreading any reduced (or inexistent) financial differentials in the cost of indebtedness across the EU27.

However, it is worth stressing that SURE only pools a rather limited volume of the total public debt needed to finance the European response to the pandemic. As mentioned above, while SURE will make available a maximum of 100 billion Euro (and thus entail a maximum issue of that amount in EU bonds), this only represents about 1/25 or less of the total amount of public debt that the Member States will have to issue to fund the measures adopted at national level. It thus falls rather short of becoming a centralised or pooled public debt mechanism in the way the ‘coronavirus bonds’ could have been, even in the lighter version of the ‘recovery bonds’ envisioned by the European Parliament.

The main implication of this is that, even with this creative exercise in economic and financial solidarity, the economic impact of the post-pandemic economic crisis will be felt differently (and potentially, very differently) across the EU, with some countries having to pay much higher costs for their public debt than others. Given the different origin and reasons for this current (or imminent) economic crisis—as compared to the 2008 crisis—this seems to go against the grain of the basic pillars of the EU project

What next?

Regardless of the way in which the COVID-19 Package is implemented and its ultimate success—for which one can only be hopeful—the discussion surrounding its approval and the blocking of corona-bonds in particular have left some difficult questions unaddressed. To what extent is the current model of economic and financial governance in the EU (and the Eurozone) viable in the long-term and truly equitable? Is there a need for more centralised public debt mechanisms? If so, how centralised should they be? Is the European Commission in a good position to administer very large hub and spoke mechanisms? If not, how should any existing shortcomings or challenges be addressed?

As always, the answer to such type of fundamental questions of EU governance will trigger different answers from technical or normative perspectives, as well as from Eurosceptic or Europtimistic corners. Being a Europtimist, I can only say that, in my view, this crisis has shown that we need more, not less Europe—as clearly evidenced in the area of public health, but not only. This likely means a more (or fully) integrated economic and financial governance, including a calmer and truly based on solidarity discussion on public debt pooling and the potential reinvention of EU budgetary rules. Let’s not wait to tackle those important issues until the next crisis. One day, it may be a crisis too many.

This article is part of a Series on “Beyond the Pandemic”, published in the week before and after the 9th of May, Europe’s Fest. It was published as well on the Brexit Institute Blog

Albert Sanchez Graells is a Professor of Economic Law and Co-Director of the Centre for Global Law and Innovation, University of Bristol Law School

Image credit: Berlin Central Station under a Pixabay License